Let’s be honest. For a long time, crypto investing felt a bit… extractive. The old proof-of-work model, for all its genius, guzzled energy like a supercomputer left running in a rainforest. And the chase for the next 100x meme coin? Well, it often left portfolios—and principles—in tatters.

But a shift is happening. A quieter, greener revolution. Investors are now asking: can my portfolio grow and do good? Can it be resilient and regenerative?

The answer is a tentative yes. And it hinges on two powerful ideas: proof-of-stake (PoS) and regenerative finance (ReFi). Building a sustainable crypto portfolio isn’t just about avoiding harm anymore. It’s about actively choosing protocols that heal, reward thoughtfully, and build a sturdier financial future. Let’s dive in.

Why Sustainability is Your New Portfolio’s Best Friend

First, a quick mindset shift. Think of sustainability not as a constraint, but as a filter for quality. In fact, a sustainable approach naturally screens for projects with long-term vision, robust governance, and real-world utility. It’s like choosing a well-built, energy-efficient home over a flashy house of cards.

The regulatory winds are blowing this way, too. Energy consumption is a huge spotlight. And let’s face it, the existential dread of watching your asset’s network contribute to a carbon footprint… it takes the joy out of gains, you know?

The Foundation: Proof-of-Stake (PoS) Explained (Simply)

Okay, jargon-busting time. Remember proof-of-work (PoW)? It’s like a global math competition where miners burn massive energy to win. Proof-of-stake is different. Imagine a lottery where your chances of winning are based on how many tickets you’re willing to lock up as a “stake.” More stake, better odds of being chosen to validate the next block and earn rewards.

The key benefits for your portfolio building strategy?

- Energy Efficiency: PoS networks use ~99.95% less energy than PoW. Full stop.

- Accessible Yield: You can “stake” your coins to help secure the network and earn rewards—like interest. This is a core income stream for a sustainable crypto portfolio.

- Governance Rights: Often, staking gives you a say in the network’s future. You’re not just a passenger; you’re part of the crew.

Ethereum’s move to PoS (The Merge) was a watershed moment. It legitimized the model for the entire industry. So, starting with PoS assets is now a no-brainer for foundational holdings.

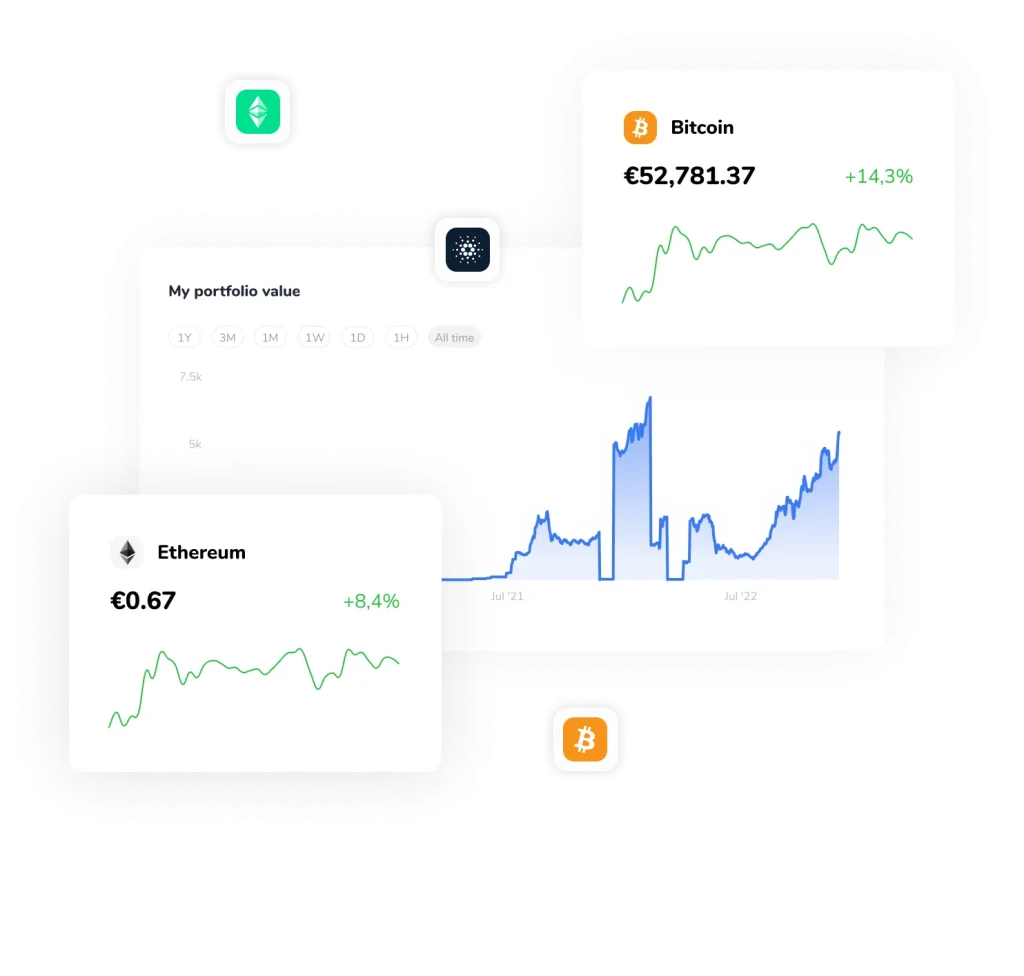

Core PoS Assets to Consider

Your portfolio’s bedrock. These aren’t speculative punts; they’re the pillars.

| Asset | Role | Sustainability Angle |

| Ethereum (ETH) | Smart contract platform | Post-merge, the green backbone for countless dApps. |

| Cardano (ADA) | Research-driven platform | Built with peer-reviewed academic rigor from the ground up. |

| Solana (SOL) | High-throughput chain | PoS model designed for speed and lower energy impact. |

| Polkadot (DOT) | Interoperability network | Connects multiple blockchains, shared security model. |

The Next Layer: Weaving in Regenerative Finance (ReFi)

Here’s where it gets truly exciting. If PoS is about doing less harm, regenerative finance is about creating more good. ReFi uses crypto tools—tokens, smart contracts—to tackle environmental and social issues. It turns your capital into a force for regeneration.

Think: carbon credit tokenization, funding mangrove restoration via DAOs, or community-owned solar farms. You’re investing in the planet’s infrastructure, and the returns aren’t just financial.

How to Add ReFi Exposure

This is the growth-oriented, impact layer of your portfolio. It’s more nascent, so position size accordingly. But the potential? Massive.

- Carbon Credit Tokens: Look at tokens like Toucan Protocol’s TCO2 or KlimaDAO. They represent real, retired carbon credits on-chain. Their price can be volatile, but they directly fund carbon sequestration.

- Green DAOs and Projects: Some DAOs pool funds to buy and protect land (e.g., EcoDAO). Others fund renewable energy projects. Do your diligence here—look for transparent, verifiable impact.

- Regenerative Stablecoin Yields: Platforms like Ethic (on Celo) let you earn yield on stablecoins that’s generated by funding green assets. Your USDC isn’t just sitting there; it’s financing a microloan for a clean cookstove.

Putting It All Together: A Sample Portfolio Blueprint

Alright, theory is great. But what does this look like in practice? Here’s a thought-starter framework. Adjust based on your own risk tolerance, honestly.

- Foundation Layer (60-70%): Core PoS assets. ETH, maybe ADA or DOT. Stake these for steady, network-securing yield.

- Regenerative Layer (20-30%): Allocated to ReFi projects. A mix of carbon tokens and deposits in verified green yield platforms. This is your impact engine.

- Exploration Layer (10%): For the new, early-stage PoS or ReFi experiments you believe in. Higher risk, but keeps you connected to innovation.

Remember—diversify within each layer. Don’t put all your ReFi allocation into one carbon token. Spread it across different verticals: carbon, conservation, clean energy.

The Inevitable Challenges & How to Navigate Them

It’s not all smooth sailing. ReFi is young. Some carbon markets have faced criticism over credit quality. “Greenwashing” exists in crypto, too. Here’s the deal: you must become a detective.

- Verify, Don’t Trust: Can the project prove its impact with real-world data? Look for on-chain verification and partnerships with established NGOs.

- Embrace Volatility: Impact tokens can be wildly volatile. That’s why they’re a layer, not the whole portfolio.

- Tech Risk: Smart contracts can have bugs. Use well-audited, time-tested platforms when you can.

A Final Thought: Beyond the Balance Sheet

Building a sustainable crypto portfolio with a focus on proof-of-stake and regenerative finance does something subtle. It re-aligns your incentives. Your financial success becomes subtly tied to the success of a greener grid, a healthier atmosphere, a more equitable system.

You’re not just hodling. You’re participating. The yield you earn comes from securing a network that doesn’t cost the earth, or from funding a project that actively heals it. That’s a powerful story for your portfolio—and maybe, for the future of finance itself.