Investing in cryptocurrency is a great way to earn a decent return on your investment. However, you should be careful not to invest all of your capital in one single digital currency. A smart move is to invest a small percentage of your capital in cryptocurrency to avoid risking too much money. You can also try investing in multiple digital currencies. A good cryptocurrency portfolio management tool will help you to monitor the performance of multiple currencies simultaneously. These tools will help you to keep a track of your investment.

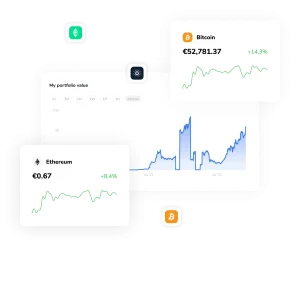

There are many cryptocurrency portfolio management tools available online. Some of the most popular tools include Shrimpy and CoinDesk. Both provide a universal exchange interface. Users can link all their crypto exchanges within seconds and view all their portfolios from one dashboard. They also have convenient tracking capabilities. For example, FTX allows you to back-test your portfolio using up to 5 years of historical data and has price alerts. These features will help you create the most profitable cryptocurrency portfolio and avoid losing your money.

Some of the most popular cryptocurrency portfolio management tools include CryptoGlobe and Shrimpy. Both of these tools offer the ability to manage multiple cryptocurrency exchange accounts. By linking all your accounts, you can keep track of all your assets in a single, convenient dashboard. For those with a lot of money, Shrimpy can help you manage your cryptocurrency portfolio with ease. Additionally, it offers convenient tracking capabilities. In addition, you can back-test your portfolios using up to five years of historical data. And, you can even use their technology to create leveraged loans or other financial instruments.

For example, if Coin A makes up 40% of your portfolio, then selling 10% of it can increase the value of Coin C. Then, when Coin C rises in value, you sell the other 10% and buy Coin A and B. Then, your investment portfolio is more than doubled. This strategy requires patience, but it’s not impossible. You can use your favorite cryptocurrency portfolio management apps and track your investments. This is the key to managing your crypto assets.

Moreover, you should keep an eye on the price of different crypto assets and diversify your portfolio. You need to use a software that lets you monitor your cryptocurrency holdings and trades. The prices of cryptocurrencies are often volatile and can go up or down rapidly, so you need to be prepared to deal with these fluctuations. The best way to protect your assets is to diversify your assets among different currencies and exchanges. If you’re new to the crypto market, there are plenty of options to start investing.

A good cryptocurrency portfolio management software can help you stay on top of your cryptocurrency investments. It should also offer a universal interface for trading on various exchanges. This will make it easier to access all your portfolios in one place. Moreover, it provides convenient tracking capabilities and backtesting capabilities. It allows you to analyze historical data for your crypto accounts. Once you’ve built a strong strategy, it will be easy to track your investment.