Let’s be honest. In a world where every online purchase, coffee run, and digital tip seems tracked, the promise of privacy coins is incredibly tempting. You know, cryptocurrencies like Monero, Zcash, or Dash that are built specifically to obscure transaction details. They offer a digital version of paying with cash—untraceable, unlinkable, and frankly, liberating.

But here’s the deal. That very promise puts these assets on a collision course with global financial regulations. Using them for everyday stuff isn’t just a technical challenge; it’s a tightrope walk between personal privacy and legal compliance. This article isn’t about picking a side. It’s a practical map for navigating that tricky, often confusing, middle ground.

The Allure of the Shield: Why Privacy Coins Exist

First, a quick sense-check. Why would anyone need a privacy-focused cryptocurrency? Well, Bitcoin isn’t as anonymous as people think. Its ledger is public and permanent. With some sleuthing, transactions can be traced back to real-world identities—a feature that’s a bug for anyone valuing financial confidentiality.

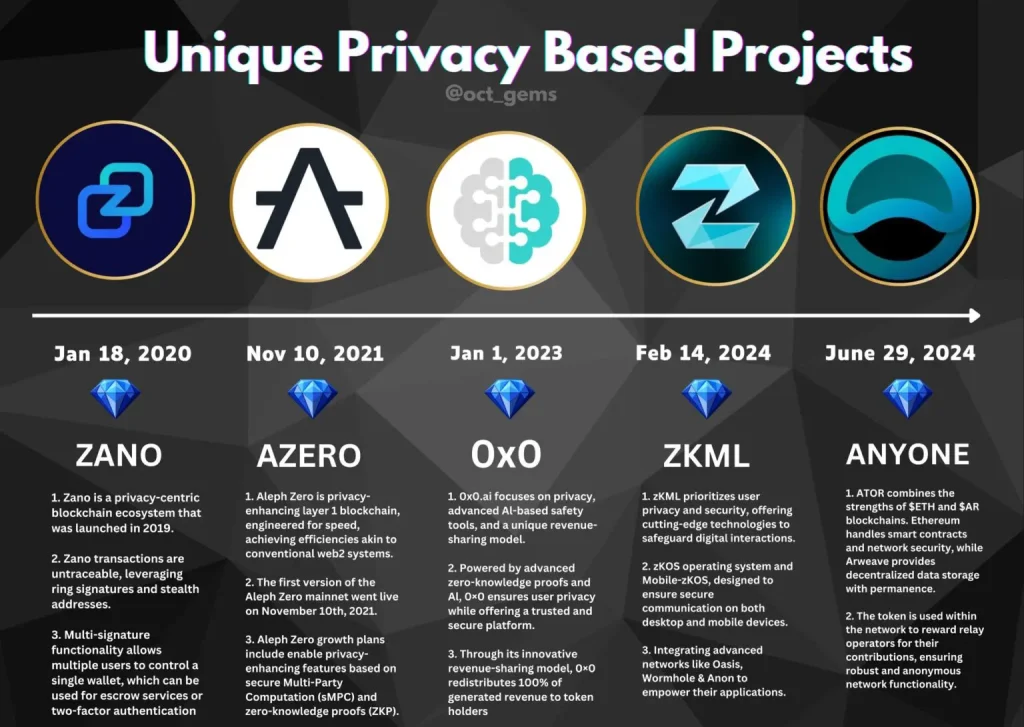

Privacy coins fix this. They use cryptographic magic—things like ring signatures, stealth addresses, and zero-knowledge proofs—to hide sender, receiver, and amount. Think of it like sending a sealed, unmarked envelope through a network that shuffles it with thousands of others. Even the postmaster can’t tell who sent what to whom.

Everyday Uses (Beyond the Obvious)

Sure, the narrative gets dominated by extreme use cases. But for regular folks, the appeal is simpler:

- Personal Financial Privacy: You might not want your family, colleagues, or that nosy neighbor who saw your wallet address to know every charity you support or every small business you buy from.

- Shielding Commercial Sensitive Data: A freelancer working with competitors, or a startup protecting its operational spending from prying eyes. It’s about business confidentiality.

- Protection Against Targeting: Public ledgers can make you a target for phishing, extortion, or physical theft if your holdings are visible.

- Simple Consumer Choice: Just like some people prefer cash over credit cards for daily errands, it’s a preference for disconnecting spending from identity.

The Regulatory Reality Check

And this is where the plot thickens. Governments and financial watchdogs have a job: to prevent money laundering, terrorist financing, and tax evasion. Their main tools? The “Travel Rule” and Know-Your-Customer (KYC) laws. These require financial institutions to identify parties in a transaction.

You can see the clash. A currency designed to be untraceable is, from a regulator’s desk, a red flag the size of a billboard. Major exchanges in the U.S., Europe, and elsewhere have already delisted privacy coins under pressure. Japan and South Korea have outright banned them. The regulatory landscape is a patchwork, and it’s tightening.

The Compliance Tightrope: A User’s Guide

So, if you want to use these technologies without inadvertently stepping into legal gray areas, what do you do? It’s about proactive navigation.

| Principle | Practical Action | Why It Matters |

| Transparency on-Ramp/Off-Ramp | Use only fully KYC-compliant exchanges to convert fiat to crypto (and back). Declare this activity in tax reports. | Creates a clear, legal audit trail for your entry and exit points. It shows you’re not hiding your overall financial activity. |

| Purpose & Documentation | Keep records of transactions for legitimate purchases (receipts, invoices), even if the chain itself is private. | Demonstrates legitimate intent. You can prove the source of funds and the purpose of a transaction if ever questioned. |

| Jurisdiction Awareness | Know the laws of your country and the country of any service you use. Ignorance isn’t a defense. | Prevents accidental breaches. Using a VPN to access a banned service, for instance, carries serious risk. |

| Embrace “Selective Disclosure” | Some tech, like Zcash’s shielded and transparent addresses, allows you to choose when to reveal details for audit purposes. | This might be the future model—privacy by default, transparency by choice for compliance. |

The Future: Can Privacy and Compliance Coexist?

It feels like a standoff, doesn’t it? But the future might not be a winner-takes-all battle. We’re starting to see the contours of a compromise. Think of it like a secure, private home. The authorities can’t just barge in, but with a legitimate warrant (a court order), there could be a technological way to provide specific information without tearing down the whole house.

Projects are exploring “auditable privacy” or regulatory-compliant protocols. These would allow users to provide zero-knowledge proofs that a transaction was legal—proving, for example, that the funds came from a legitimate source and weren’t sent to a sanctioned address—without revealing every single detail. It’s proving you followed the rules without showing your entire hand.

For now, though, the burden falls on the user. The path forward is nuanced. It means accepting that using these tools requires more diligence, not less. It means understanding that privacy isn’t secrecy—it’s the right to control your own financial information, and with that right comes responsibility.

A Final, Personal Thought

Navigating this space is, honestly, a bit like learning to drive in a new city with constantly changing road signs. The technology gives you a powerful, private vehicle. The regulations are the rules of the road. You can use the car to get somewhere amazing, but you still have to stop at red lights and signal your turns.

The core tension—between individual autonomy and collective security—won’t be solved anytime soon. But by making informed choices, keeping records, and respecting the legal frameworks of your region, you can still explore the value that privacy-focused cryptocurrencies offer. You just have to drive with your headlights on, and your eyes wide open.